Past-due payments can create big headaches for companies in a B2C model. Not only do they impact cash flow, impeding core business functions in the process, but the negative sentiments created during the debt collection process also damage member relationships. You shouldn't be writing off a members because they are falling behind on their bills.

You can improve cash flow and boost member retention by offering payment plans to help your past-due members resolve their debt. Let's dive into how payment plans can do this.

What Is a Payment Plan?

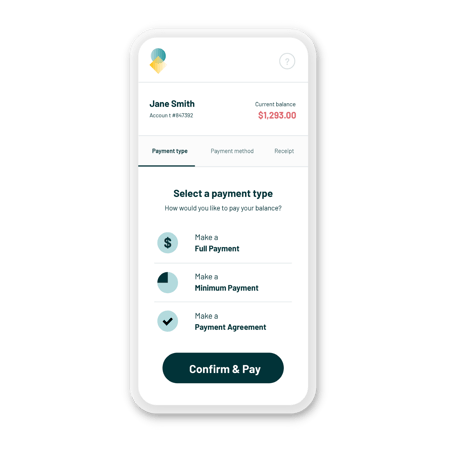

Payment plans break down the total consumer debt into manageable chunks to repay along a predetermined timeline. For example, if a member owes $100, then with a payment plan, they might agree to pay $25 per month for four months. Payment plans may also bake in fees or interest charges.

Before charging late payment fees or interest charges, check to ensure that you're in compliance with local laws. Even if you can levy additional charges, it may be in your best interest either to waive all charges or levy only a token fee to earn goodwill and increase member loyalty and retention.

Often, payment plans are tailored to the member's ability to pay. For example, a low-income earner may only be able to put $10 toward their monthly debt. While this might seem too small to be helpful, it's essential to approach debt collection with the mindset that it's better to collect something than to recover nothing. Many cash-strapped individuals are happy to resolve their debts if given the time and space.

These plans share some similarities with the increasingly popular BNPL trend, which allows members to purchase consumer goods via payment installment plans at the time of purchase. With growing economic uncertainty and the grim prospect of a recession on the horizon, companies have spurred sales by adapting their sales processes to offer consumers greater payment flexibility.

How Can You Benefit From Payment Plans?

With a traditional debt cycle, you spend valuable time and resources chasing after payments in full, often unsuccessfully. These outstanding debts are usually sold for pennies on the dollar and become an overall loss, negatively impacting cash flow forecasts and bad debt ratio. With payment plans, you are more likely to recover the total value of your member's debt, which increases cash flow and improves your bad debt ratio.

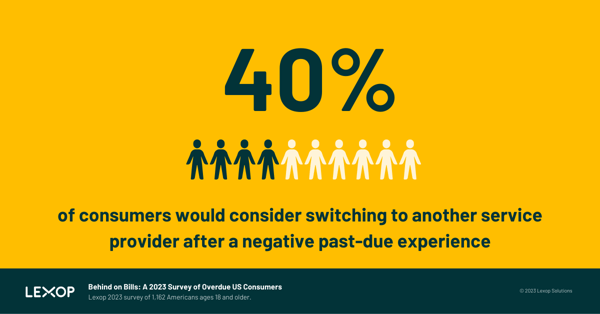

According to our recent study of past-due consumers in the U.S., 32% were not given any payment plan options. In the same report, 40% of respondents said they would consider switching to another provider after a negative past-due experience.

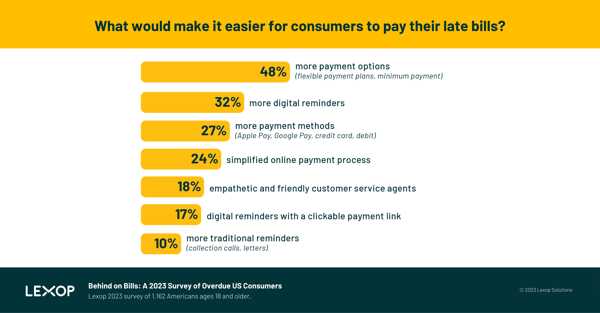

The traditional debt collection process often leads to losing hard-earned member relationships. Flexible payment plans soften the debt collection process. Members are more likely to repay their debt when given empathy and understanding. 48% of consumers say more payment options, including flexible payment plans and minimum payments, would make it easier to pay their late bills.

Payment plans also offer critical insight into consumer behavior, such as the payment amount most members feel comfortable making monthly. These insights can yield benefits down the road by helping you to understand your members better and their spending habits, which in turn can positively influence your business's pricing decisions. These plans also provide your business with greater and more predictable cash flow.

What to Consider When Offering Payment Arrangements

Before offering payment arrangements to all members, you can send proactive reminders, and if that doesn't work, payment plans are a great option before writing off the debt or turning to 3rd party collections.

Allowing members to pay by various methods like Credit Card, ApplePay, or Debit can help secure payments. Digital payment options lessen the embarrassment, frustration, and stress of over-the-phone transactions. Members appreciate the simplicity and ease of in-app and online payment systems.

Automating reminders with payment links lets you reduce phone transactions and follow-up calls, giving your staff more time to focus on accounts that require more attention. Overall, this will lead to improved efficiency and cost savings.

With so much economic uncertainty on the horizon, you can't afford to be rigid about payment plans. Enhance your bottom line by empowering your members with flexible payment arrangements. Lexop's debt collection solution integrates into your existing payment gateway. You can easily set up payment plans with your chosen amounts and intervals to improve your cash flow and increase members loyalty.

.jpg?width=575&name=daria-nepriakhina-_XR5rkprHQU-unsplash%20(1).jpg)